Robinhood’s Playbook: Increase FOMO or GTFO

How Robinhood appeals to the youth-iykyk

Ever wonder how Robinhood changed a traditional industry dominated by incumbents? Learn how they appeal to user needs and how you can adopt their strategy for your work.

Many have said that to find a successful product, look no further than the Seven Deadly Sins. If a product addresses one of those “needs,” the team is probably on the right track.

Robinhood plays into the Deadly Sin of greed perfectly. I’m being a little facetious, but people invest their money to build wealth and it is the promise of future wealth that drives investing behavior today.

The Nuances of Greed

If you had to categorize all the tools and platforms to invest your money, the Fidelity’s and Charles Schwab’s of the world attract the old school thinkers—people who slowly build a treasure chest over time.

But there is another segment of users that don’t believe they should have to wait decades to build wealth. If they are smart enough and can beat the market, they can get rich quickly. To them, it’s a game and this is exactly where Robinhood has been able to carve out their piece of the market.

Robinhood is building a product for the segment of (the Deadly Sin of greed) users who experience FOMO when it comes to the next stock that is run up by retail investors.

Yes, it probably isn’t the best financial decision to chase meme stocks, but there is a legitimate market for this type of user. They are often younger, have their first introduction to investing, and want a platform that is easy to understand and use. Robinhood has leaned into all of these things to get this segment of investors in the game, even if it does mean embracing the FOMO culture.

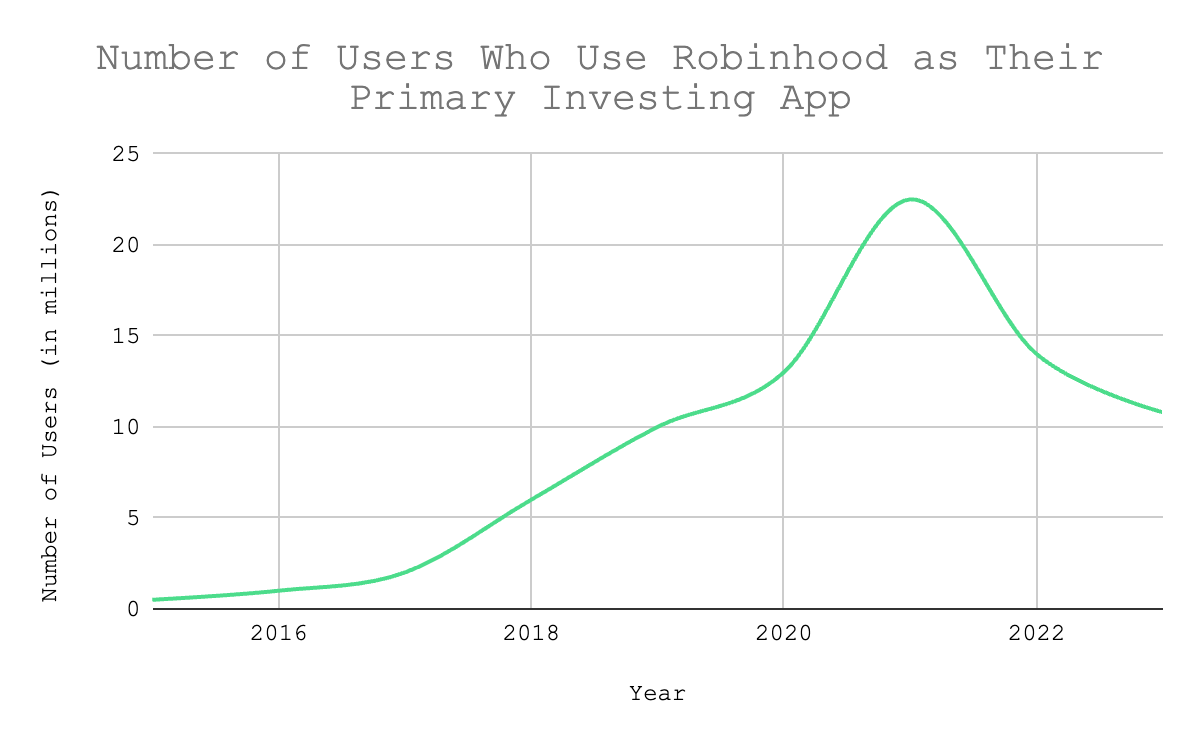

As you can see from the graph below, the number of Robinhood users peaked when NFTs, crypto, and the Gamestop stock peaked. Robinhood was viewed as the easiest way to buy and sell Gamestop and other meme stocks among the FOMO crowd.

With the decline in users using Robinhood as their primary investment app since then, there is likely a lesson in retention to be had, but that’s for another time.

Business Goal

Investopedia states, “Robinhood makes money in many ways, notably through a system known as payment for order flow. That is, Robinhood routes its users' orders through a market maker that actually makes the trades and compensates Robinhood for the business at a rate of a fraction of a cent per share.”

In essence, Robinhood makes money on every trade. An increase in trading volume is an increase in revenue.

The more time they can get users to log in and be on the platform every day, the more they will increase their chances of users making a trade. Daily Active Users (DAU) = increased trading volume = $$$. So, how does Robinhood do this through a seamless user experience?

Embracing its Value Proposition

Robinhood speaks to its users’ problems and needs the moment they land on the website.

“Put in a buck or a billion. Earn extra every time,” is written in gold, appealing to the Deadly Sin of greed.

“Join a new generation of investors” appeals to a new way of investing money. It’s young and hip. This isn’t your grandfather’s app. Robinhood knows its audience and speaks the language that appeals to them.

Gamification

Robinhood’s app is like an online casino, so much so that they were fined by the state of Massachusetts for gamifying online trading. With confetti glittering across every user's phone screen as they complete actions that lead to a trade, regulators finally said Robinhood went too far.

Robinhood uses rewards to help users feel they are progressing toward their wealth goals. The app sets milestones for users as they complete educational modules, diversify their investments, and reach saving goals.

These rewards progress with the user as they become more educated and sophisticated in their trading behavior. You can’t talk about Robinhood’s gamification without mentioning the chance to win free stock to some of the world’s best companies as milestones are met (even if the chance of winning an Apple stock is quite low).

To ensure users continually come back to meet their milestones, Robinhood provides real-time notifications when stock prices change, encouraging users to quickly buy and sell during these fluctuations. It gives users a dopamine hit every time they receive a notification or open the app.

Simplifying the Complex

Historically, stock trading has been viewed as something only the financially literate and wealthy do. Robinhood has helped change that perception by making trading extremely accessible and easy to understand for new generations of investors.

They offer education to understand the ins and outs of stocks, giving users confidence in their investments. Robinhood calls it democratizing access to financial literacy, but I call it breaking down barriers to increasing trading frequency.

Key Takeaways

What can we learn from Robinhood to, in turn, make products people love?

Focus on what users deeply want: In this case, it’s about making money and building wealth. Don’t shy away from asking “why” a few times to get to the true reason people engage with a product.

Make a boring thing fun: No 20-year-old had ever told their friends about “their awesomely cool investment app” until Robinhood came along. By speaking to the “kid” in us and making investing a game (and maybe slightly addicting), Robinhood became as fun to use as Flappy Birds.

Break down complex processes: Simplicity is king when trying to re-engage users day after day. By addressing barriers to entry and tackling education, Robinhood allowed new investors to have confidence depositing their hard-earned cash into the app.

Did you like this breakdown of how the Robinhood user experience meets the needs of its users to accomplish business goals? If so, you can support me by subscribing and sharing this with your friends.